Whether you are about to create your own financial plan or review it, Sum is able to analyze your personal situation and provide independent solutions.

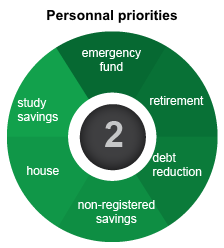

A financial plan helps you:

- Know where your money goes

- Protect your assets and your family in the event of death or disability

- Prepare for the various phases of your life

- Optimize your retirement savings

- Protect your hard-earned savings against the unexpected

- Manage your income tax

We all have objectives and dreams, be they paying for our children’s education, traveling, starting a business. Are you ready to do everything you can to achieve them?

The financial decisions you make today have an impact on the amount of money available to achieve said dreams and objectives.

You can secure your own financial future – all you need is a plan.